“Stagflation” is an unpleasant memory for anyone who lived through the Carter economy of the late 1970s. Economists are now warning that the U.S. is beginning to enter a new period of stagflation, defined as the combination of high unemployment and rapidly rising price inflation along with slow economic growth.

Stagflation presents the Federal Reserve and Washington policymakers with difficult decisions and dilemmas, as regulatory actions intended to bring down price inflation are often likely to exacerbate persistent unemployment.

New York University economist Nouriel Roubini wrote last month that “mild” stagflation might already be underway. He stated that inflation is rising while growth is “slowing sharply,” even though the U.S. and other nations continued with “massive monetary, credit, and fiscal stimulus.”

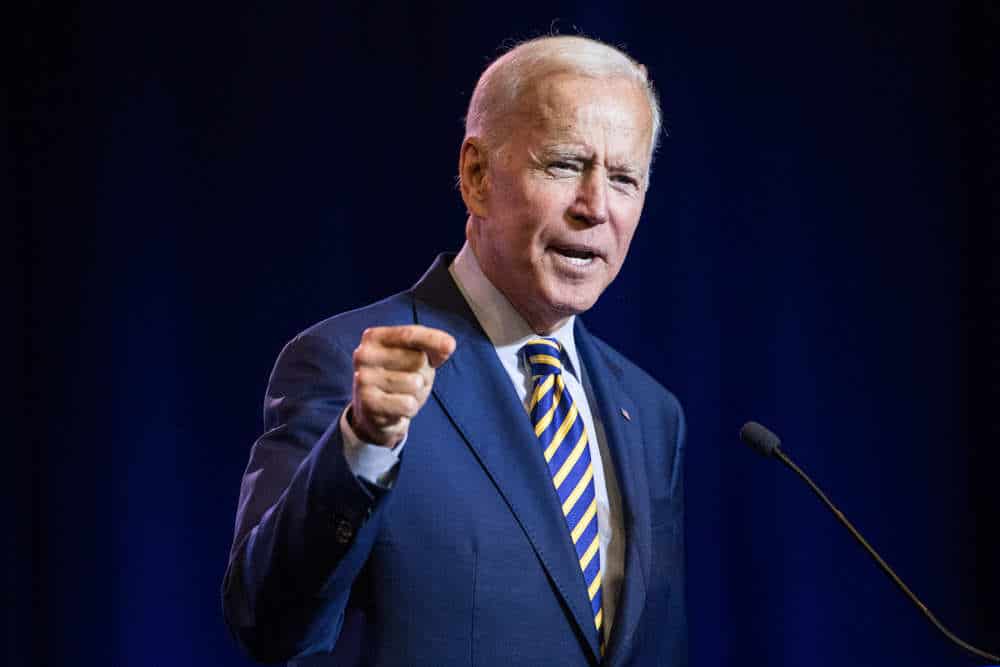

Inflation is becoming more of a hot-button issue among politicians and even the corporate press as the Biden administration is feverishly pressing forward with a proposed $3.5 trillion spending bill. Many economists warn that massive increases in government spending will accelerate price inflation and reduce consumer confidence.

The spending bill is far from a “done deal,” facing stiff opposition from Republicans and even some Democrats. Sen. Joe Manchin (D-WV) has stated that he believes the proposed spending “not only ignores present economic reality,” but also makes a fiscally weak position a certainty when America faces a “future recession or national emergency.”

Inflation has reached a 13-year high, with a 5.3 percent increase over last year. According to Department of Labor statistics, official unemployment sits at 5.2 percent. However, job growth slowed last month to its lowest level in seven months. As labor participation rates are flagging, many fear that “real” unemployment is much higher than reported. Many open jobs remain unfilled around the country.

Inflation is continuing to grow for many essential consumer products as energy prices shoot higher throughout the summer. Increased demand when winter comes has many economists concerned that consumer prices will spike even further.

Jeffrey Halley with OANDA Asia Pacific Pte. told Bloomberg last week that he is concerned that we may see a “very sharp spike” in energy prices in the last quarter of this year, which would “feed-through” to even more price inflation.

Rising energy costs appear to be a given, considering the Biden administration’s decision to ban new gas and oil production on federal land and has permanently blocked the completion of the Keystone XL oil pipeline project.

A Fox News poll from August indicates that almost 80 percent of registered voters in America blame Biden for this year’s price inflation.